A properly executed and funded buy-sell agreement with life and disability insurance can provide stabilization and continuity of a closely held business.

Many closely-held businesses fail to make plans to transition their business interest in the event of:

Lack of planning due to a triggering event can cause a business to fail. A buy-sell agreement funded with life and disability insurance can provide the funds required to transfer the business efficiently.

A buy-sell arrangement is a binding agreement in which closely held business owners agree to sell their business interests to remaining owners upon a specified triggering event. Triggering events typically include death, disability, or retirement.

A Buy-Sell Agreement protects a business in the event of the death, disability, or retirement of an owner.

A buy-sell agreement is a binding contract between co-owners. The agreement dictates when an owner can sell their interest, who can buy it, and what price will be.

A buy-sell agreement serves as a guide amongst owners allowing for an orderly transfer of ownership.

A buy-sell agreement guarantees a buyer upon a triggering event. Consequently, the buyer is usually the company itself or the remaining owners. There are several benefits to doing this.

A buy-sell agreement funded with life and disability insurance provides liquidity to an exiting owner’s family. This helps the family to maintain their lifestyle, as well as help pay for any potential estate tax liability.

Without a buy-sell agreement, it is likely an exiting owner’s family would need to sell their equity for less than fair market value.

Taking the steps to establish a fair selling price, while all owners are active, can usually be negotiated on an arm’s length basis. This should be done using one of the Methods of Valuing a Business.

Establishing a fair selling price (that each owner agrees on) removes questions about the value of a buyout upon a triggering event. However, it is important to review and keep the value current – either annually or bi-annually.

If an owner leaves the business, it is often difficult to receive a fair sale price. This happens because the remaining owner(s) hold most of the cards.

A buy-sell agreement provides a fixed valuation for estate tax purposes. This allows business owners to plan their estates. Oftentimes, the value of a closely held business will receive a discount of 20 to 30-percent due to lack of control and marketability. A buy-sell agreement can reduce the risk of valuation disputes amongst each other.

Operating a business can be incredibly difficult. When there are multiple owners it can be even more of a challenge. A buy-sell agreement exists to protect everybody who has a financial interest in the company. This includes the owners, their families, employees, etc. For this reason, it exists to help them at one of their most vulnerable times.

Think about it. A buy-sell agreement is a playbook, established when everybody is healthy, to determine what’s going to happen to the business if somebody becomes disabled, dies, retires, etc.

One of the most overlooked benefits of a Buy-Sell Agreement is to preserve harmony.

Maintaining harmony becomes much more difficult when one of these triggering events occurs. Without a buy-sell agreement, a deceased owner’s family will enter the business. This will happen whether they are active or inactive in the business.

A buy-sell arrangement can protect remaining owners from this happening while providing an equitable buyout to the deceased owner’s family.

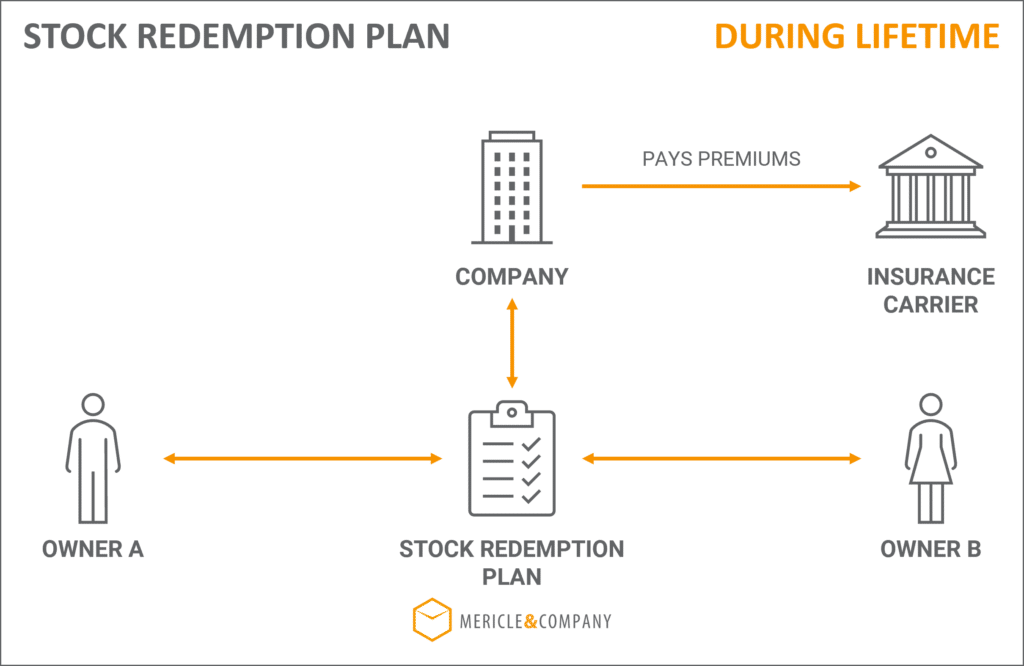

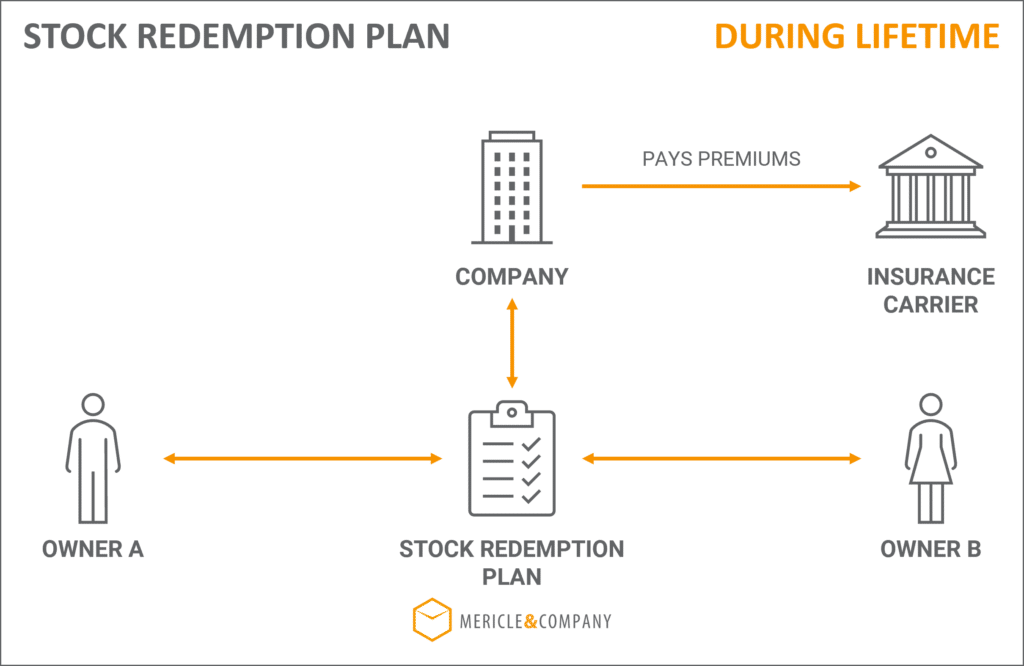

There are different types of buy-sell agreements. The most common are Stock Redemption Plans and Cross-Purchase Plans. In general, the structure and ownership of your business will dictate what type of buy-sell agreement is appropriate for your situation.

Under a Stock Redemption Plan, the company agrees to purchase the business interests of an exiting owner upon a triggering event. It also obligates the departing owner or heirs to sell their business interest back to the company.

A Stock Redemption Buy-Sell Plan should be established and funded with life insurance. Each owner is a party to the agreement. Life insurance is purchased on each owner for an amount equaling their interest in the company.

The company pays for the life insurance. The company is also the owner and beneficiary of the policy.

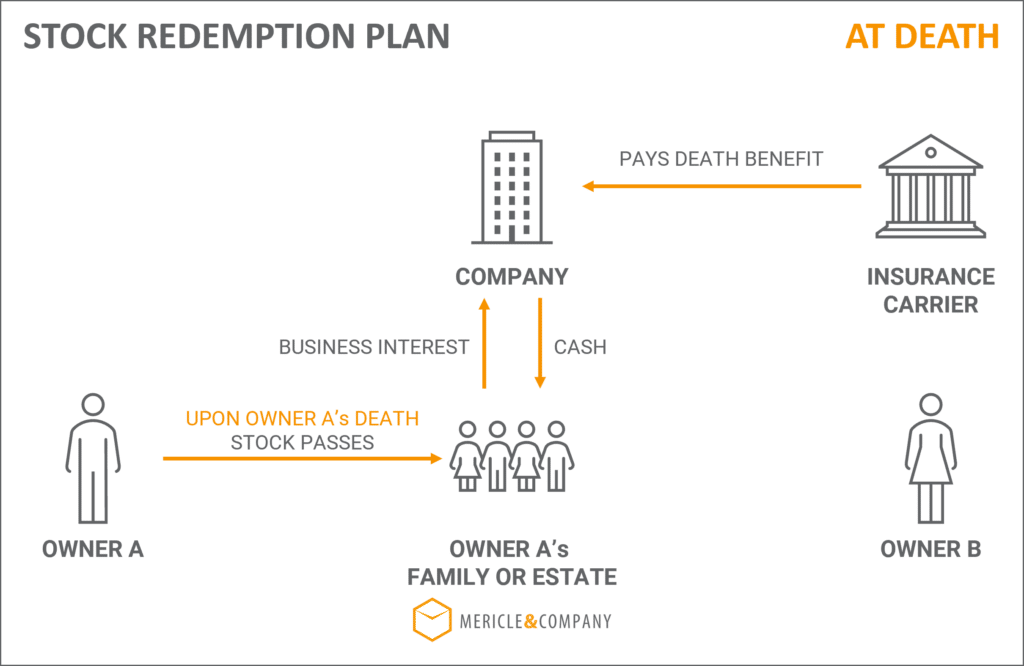

At the death of an owner, the company would receive the proceeds from the life insurance policy. The company then uses the proceeds to purchase the deceased owner’s interests from their estate or heirs at the previously agreed upon value.

The result is the deceased owner’s estate (or heirs) receives cash for the deceased owner’s interest at fair market value. The company now owns the deceased owner’s business interest. Leaving the remaining owners control of the company.

A stock redemption buy-sell plan works best for C Corporations and companies with multiple business owners. In most cases, a minimum of three business owners or more.

While a stock redemption buy-sell plan is often the easiest to set up and maintain it can have a few shortfalls.

There are several tax considerations that must be addressed when considering a stock redemption buy-sell agreement. In certain situations, the existing business owners may not receive a step-up in basis. Also, certain entities may be subject to corporate Alternative Minimum Tax (AMT). Lastly, proceeds from the life insurance policy will increase the value of the business for purposes of estate taxes.

Additionally, as with all types of buy-sell agreements, it is important to consult with your accountant or tax attorney to determine what type of agreement is most suitable for your situation and goals.

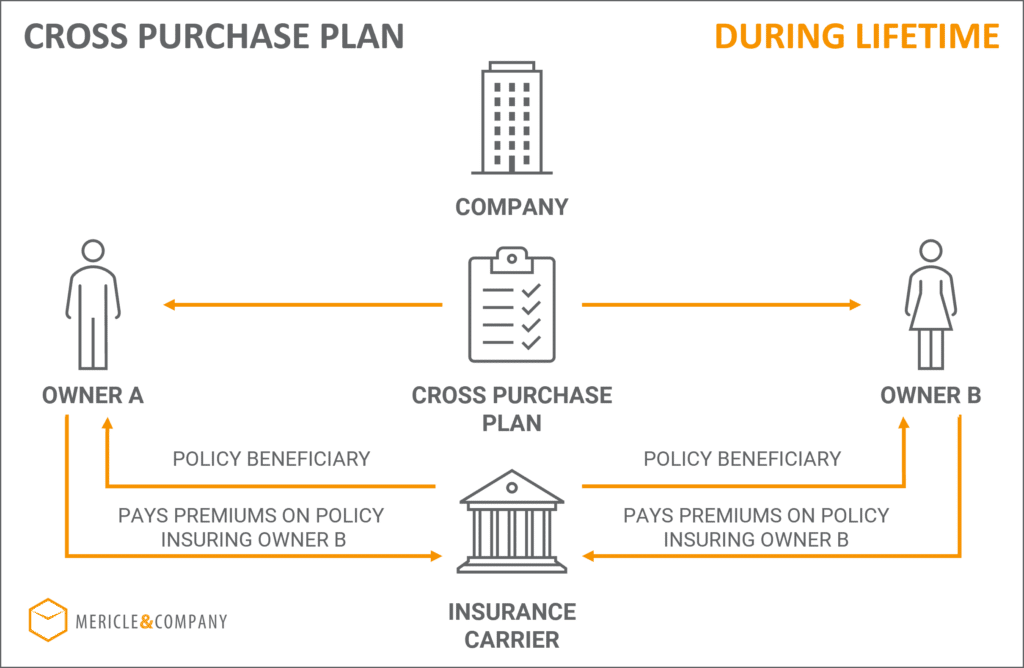

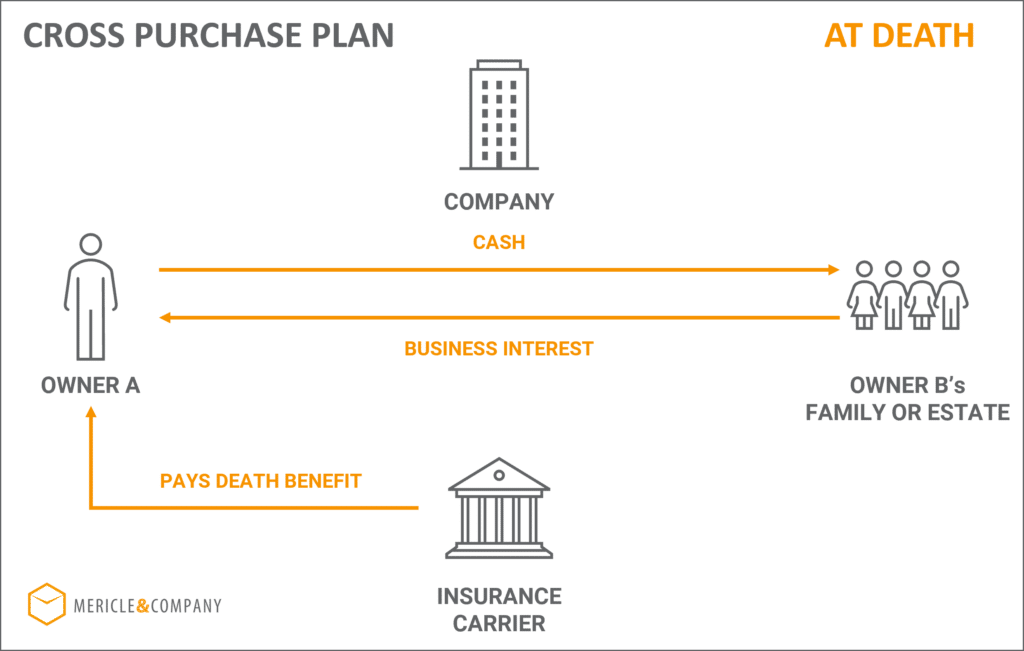

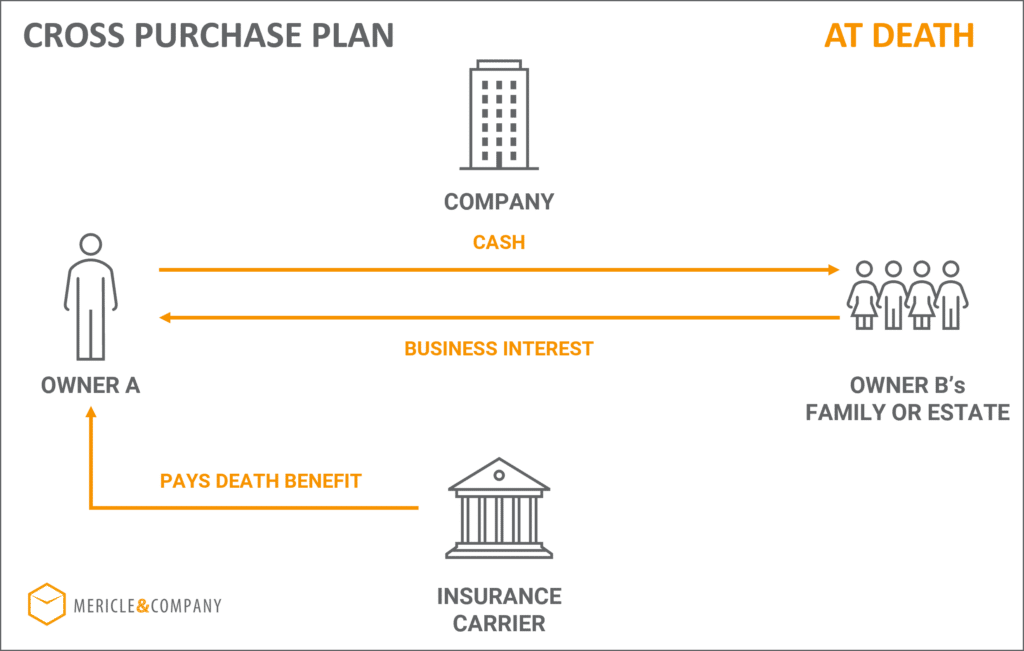

A Cross-Purchase Buy-Sell Plan requires the remaining owners of a company to purchase ownership interest from the departing owner. Each owner purchases the departing owner’s interests based on the percentage of their individual ownership.

For example, assuming three owners with the following ownership percentage:

If Owner A passes away, Owner B would purchase 30-percent of Owner A’s 50-percent interest. Based on this the ownership of the company after the passing of Owner A would be as follows:

Under a Cross-Purchase Buy-Sell Plan, the remaining individual owners will purchase the departing owner’s interest.

A Cross-Purchase Buy-Sell plan funded with life insurance requires each owner to purchase a policy on each owner(s). The amount purchased on each owner is equal to the purchase price of the interests of that owner.

For example, using our prior example with the three owners, let’s assume the company’s fair market value is $10 million. The ownership interest would be as follows:

Under a Cross-Purchase Buy-Sell Plan, each owner would purchase the following coverage:

Based on these amounts each owner would pay the premiums on the policies they own on the other two partners. They would also be the beneficiaries of the policies they own.

Upon the death of an owner, the remaining owners would use the proceeds from the life insurance policy to purchase the deceased owner’s interest from their estate. When the deceased owner’s share is purchased, the remaining owners will usually receive cost basis step-up.

A Cross-Purchase Buy-Sell Plan makes the most sense for a company with three or fewer owners. Since each owner purchases an insurance policy on every other owner, policies can be difficult to administrate.

A Cross-Purchase Buy-Sell Plan allows existing owners to maintain business continuity caused by an unforeseen death or disability. It also allows remaining owners to receive a cost basis step-up equal to the price of the purchased shares.

Because policies are owned by individual shareholders, there are fewer tax considerations compared to a stock redemption plan.

In situations where there are multiple owners, the number of policies needed to satisfy the agreement can be excessive. For example, a company with 5 owners would need 20-policies. Other considerations include differing premium payments based on the age(s) and health of an owner(s).

A One-Way Buy-Sell Agreement is an arrangement where a business owner agrees to sell their interest to a valued employee(s). The valued employee is usually a family member or key person. A one-way buy-sell agreement enables the valued employee(s) to purchase the business from the exiting owner’s estate.

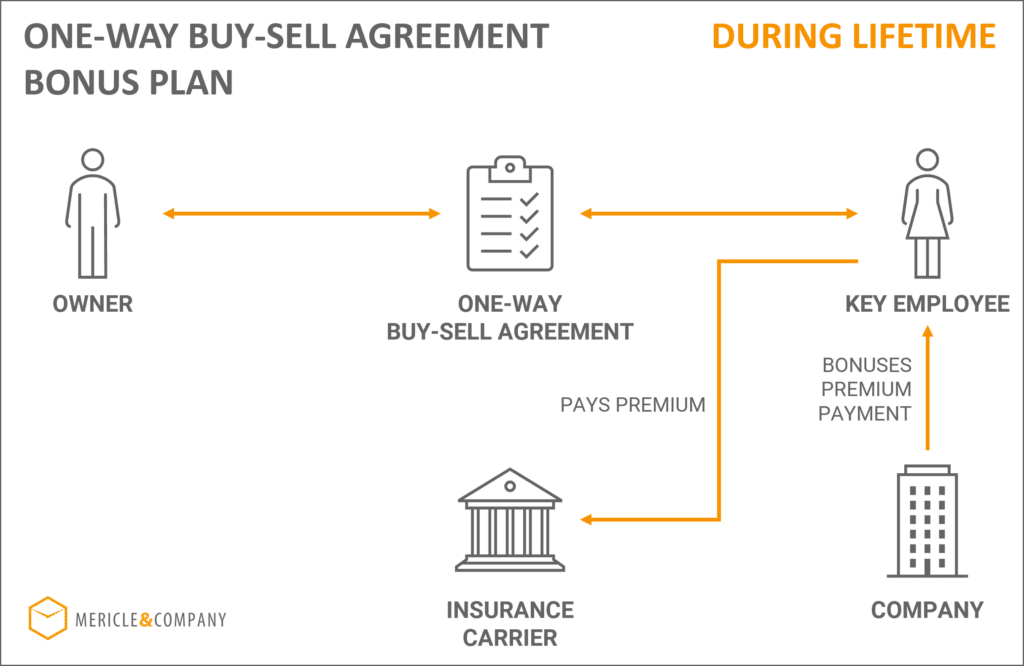

One-Way Buy-Sell Agreements are typically set up as a bonus plan or endorsement split-dollar.

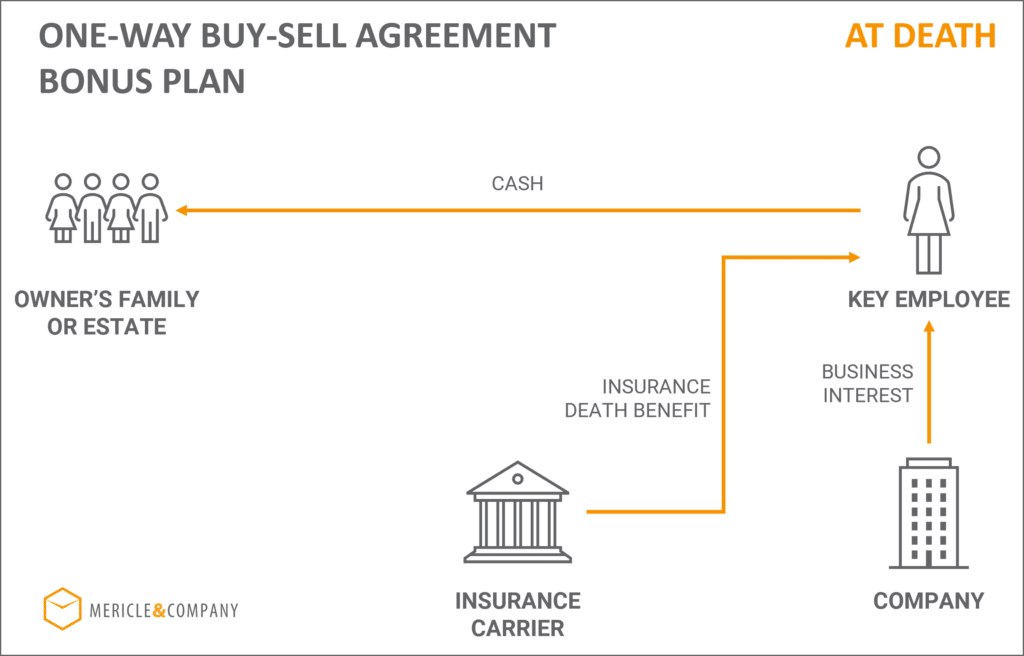

Under a bonus plan, the key employee(s) purchase coverage on the current business owner. The business makes tax-deductible contributions to the key employee(s) to purchase the coverage. When the owner passes away, the death benefit is used to purchase company shares from their estate or spouse.

DURING LIFETIME

AT DEATH OF OWNER

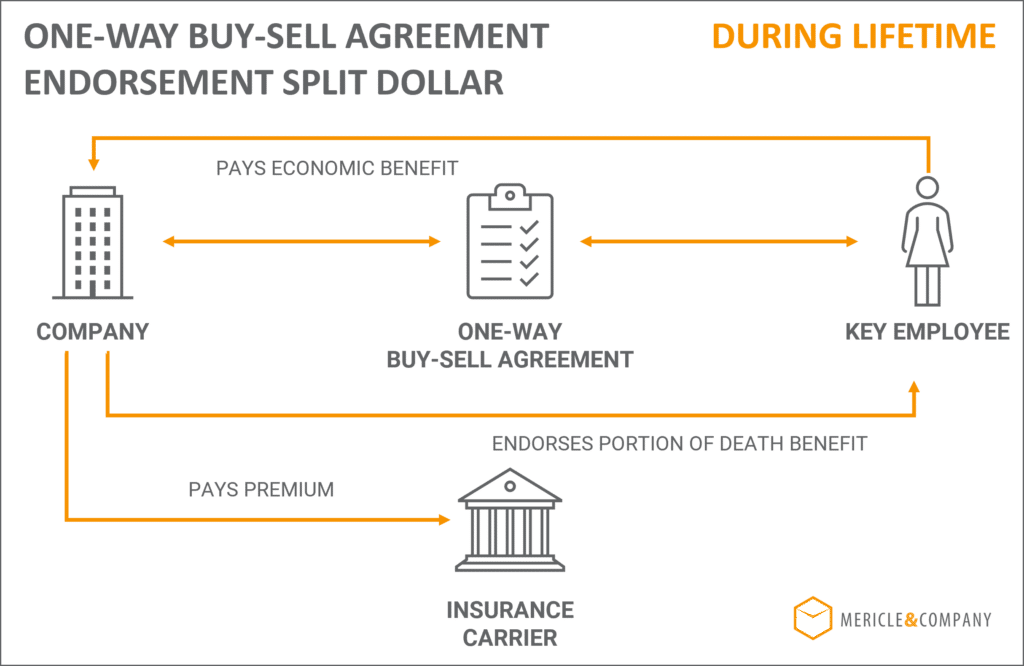

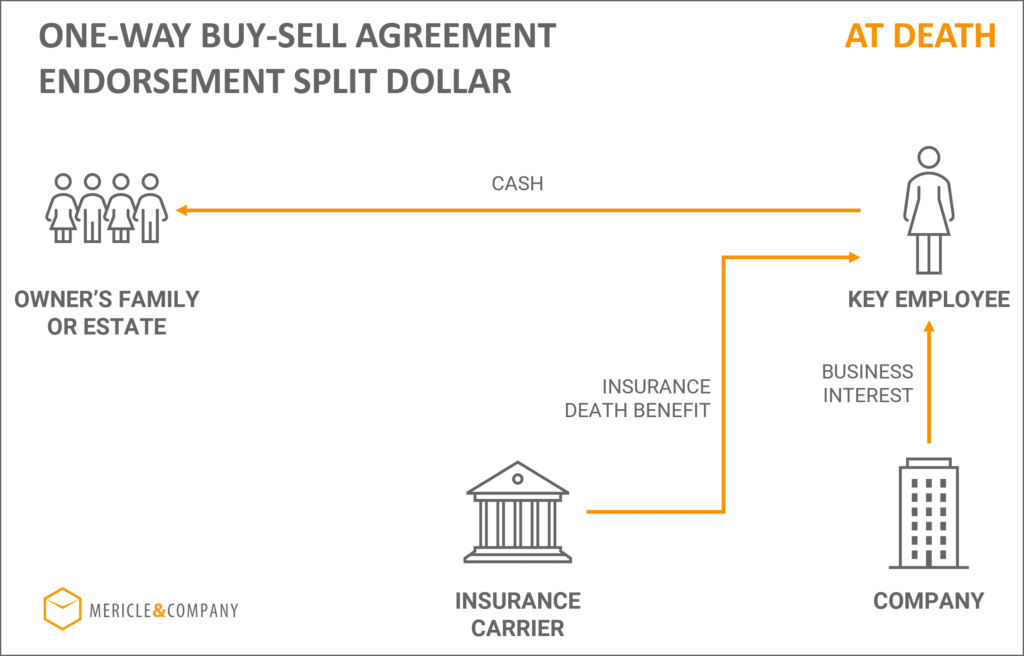

With an endorsement split-dollar arrangement the owner purchases a policy on their life. They own the policy and endorse some or all the death benefit to the key employee. The key employee will recognize an economic benefit for tax purposes on the death benefit. This type of arrangement provides the business owner with more control than a bonus plan. It is more common when a non-family member is a key employee purchasing the company.

DURING LIFETIME

AT DEATH OF OWNER

A One-Way Buy-Sell Agreement works best for business with one owner. In addition, a one-way buy-sell agreement can be of benefit in a situation where there are multiple owners, and one owner wants a family member to assume their ownership interest.

A one-way buy-sell agreement can help ensure a business owner receives fair market value for their company. It removes the risk of having to find an outside buyer willing to pay the asking price for a company. This also ensures the business owners estate or spouse receive full value for the company.

Additionally, depending on the structure of the agreement, a one-way buy-sell can provide an owner with flexibility and control of their business.

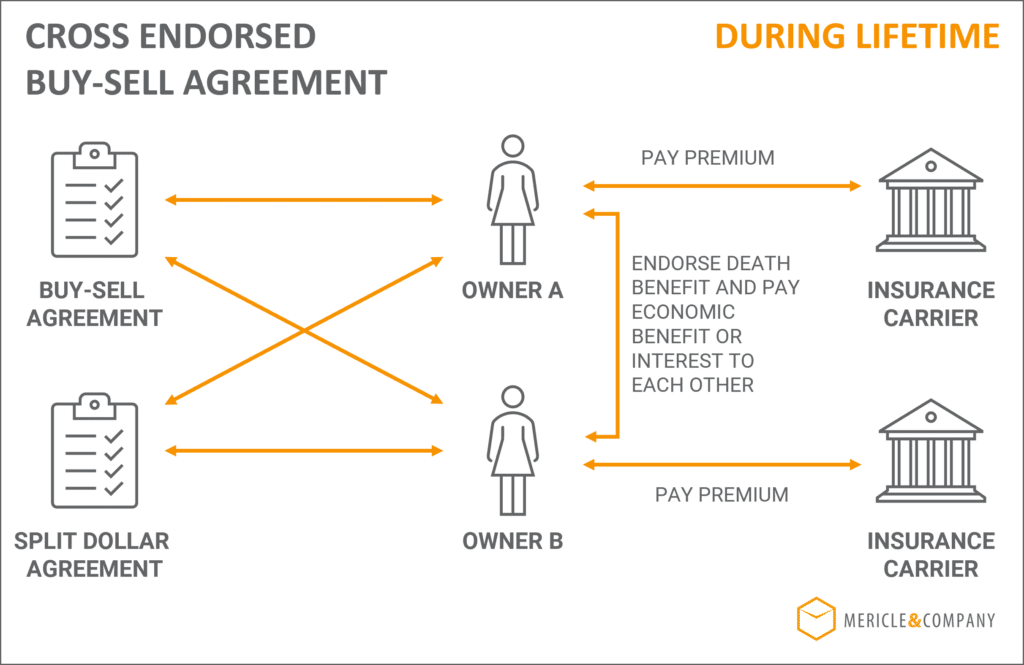

A Cross Endorsement Buy-Sell Agreement gives owners added flexibility when establishing an agreement. It removes many of the tax consequences of a Stock Redemption Plan. And, it eliminates the need for multiple policies that are necessary with a cross-purchase plan.

A Cross Endorsement Buy-Sell Agreement still provides the same benefits as any other type of arrangement. This includes establishing a fair market value, estate tax considerations, triggering events, and buyout procedures.

With a Cross Endorsement Buy-Sell Agreement each business owner purchases and owns a policy on their life. The value of the policy is based on the current and projected value of the company and each owner’s interest in the company.

For a cross-endorsement buy-sell agreement to work, each owner uses an endorsement split-dollar plan. This allows each owner to assign all or portion of the death benefit to the other business owners.

Each owner is essentially “renting” their death benefit to other shareholders to satisfy the obligations under the buy-sell agreement. Each shareholder then incurs an economic benefit cost on the death benefit they are renting.

The economic benefit is determined annually by using either an IRS or insurance company table. It takes into account the insured’s age and the amount of death benefit being endorsed. The economic benefit is usually very low, representing only a fraction of the premium.

A Cross Endorsement Buy-Sell Agreement is beneficial for business owners who want flexibility for changing needs.

A Cross Endorsement Buy-Sell Agreement gives business owners great flexibility. By endorsing the death benefit to other partners, they still have access to a policy’s potential cash values. To minimize premiums, the company can make annual bonuses to each owner.

If the company is sold or liquidated, each owner would remove the endorsement from the policy. In addition, the owner has the flexibility to choose what they do with the policy.

A Buy-Sell Agreement by itself is a legal document dictating the terms of a buyout when a triggering event occurs. Since the agreement is usually established and agreed upon when all owners are healthy, it can remove some of the ambiguity and stress when a triggering event occurs.

The easiest, least expensive, and most advantageous way to fund a buy-sell agreement is through insurance. This can include life insurance, disability insurance, and in some cases long-term care insurance. There are a number of carriers and products to choose from. Furthermore, it is important to work with an advisor who has experience and knowledge of the entire marketplace.

Failure to secure insurance as a component of a buy-sell agreement can result in financial hardship. In cases where proper insurance does not exist alternate funding methods include:

Proper insurance coverage reduces the cash flow strain placed on a company following a triggering event. It can also provide a number of income tax advantages.

One of the most important benefits of a buy-sell agreement is establishing value. This can be a fixed dollar amount or specified formula used to determine the purchase price upon a triggering event. When using a fixed value, it is good practice to revisit the valuation every year or two.

Any of the following methods can determine a company value for a buy-sell agreement:

It is important you consult with your tax advisors to assist in determining the method most appropriate. As the company grows and changes it is important to revisit the agreement and valuation when necessary. While life insurance proceeds are generally income tax-free, there are scenarios with buy-sell agreements where taxation may occur.

The agreement requires that a company’s stock is sold based on a predetermined formula to the company or remaining shareholders.

This provides the remaining owners with the first right of refusal to purchase company interests. Without a buy-sell agreement, a spouse or other family members would take over ownership.

Upon a triggering event, the remaining owners are given the first right of refusal to purchase the business interests of an owner who has a triggering event.

The purpose of a buy-sell arrangement is to have a binding agreement that lays out how business interests are to be transferred upon a triggering event.

A buy-sell agreement allows for the orderly transfer of ownership resulting from the death or disability of an owner. A buy-sell arrangement is a binding agreement in which closely held business owners agree to sell their business interest to remaining owners upon a specified triggering event such as death, disability, or retirement.

Regardless of what stage your business is in, if you have partners you should consider a buy-sell agreement. It establishes the successful disposition of business interests upon a triggering event. It generally provides remaining owners with the first right of refusal to purchase the exiting owners interests.

When establishing a buy-sell agreement it is important to determine the value and funding of the agreement. Be sure you work with an attorney and insurance advisor who understands what you are trying to accomplish.

Jason Mericle created Mericle & Company to provide families, business owners, and high net worth families access to unbiased life insurance information.

With more than two decades of experience, he has been involved with helping clients with everything from the placement of term life insurance to highly sophisticated and complex income and estate planning strategies utilizing life insurance.

Get exclusive tips and practical information to help you create, grow, sustain, and protect your wealth.