From establishing initial ownership to handling possible dissolution, operating agreements cover all the bases when starting your business.

This article will go over what you should include in a manager-managed LLC operating agreement, how manager-managed LLCs differ from member-managed LLCs, and what to consider when drafting your operating agreement.

Forming an LLC? Get a free operating agreement when you use Northwest to start an LLC for $29 (plus state fees).

We offer an operating agreement template for manager-managed LLCs, as well as an operating agreement tool that can be used to create a more customized document.

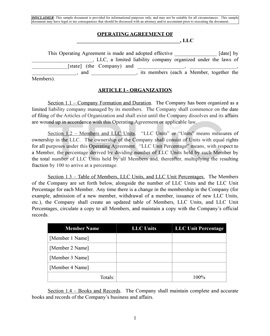

This operating agreement template is useful for multi-member LLCs that are managed by a third-party manager.

Download Manager-Managed LLC Template

Create a custom operating agreement using our free tool. Just answer a few basic questions, and the tool will develop an operating agreement for your new LLC.

To use our tool, you will need to sign in to our Business Center. A Business Center account will also grant you access to many other free tools, special discounts on business services, and much more.

TRUiC’s Custom Operating Agreement Tool

TRUiC provides a free custom operating agreement tool.

Create an AccountAn operating agreement is like the blueprint of your limited liability company (LLC). In the absence of corporate bylaws, an operating agreement lays out the structure of the company, major procedures and processes, and each member’s role, powers, and responsibilities.

While most states do not require LLCs to have operating agreements, it is highly advisable to do so. Even single-member LLCs are well served by drafting an operating agreement to outline how their business is run. This can be particularly useful in proving a meaningful separation between a single-member LLC and its owner for legal purposes.

Operating agreements are also essential for addressing conflicts that may arise within a business. This can include confusion over who has the authority to sign contracts (e.g. LLC managers, Chief Executive Manager), what happens when a member joins or leaves the business, and how to handle gridlock in decision-making. By drafting a clear and complete operating agreement, members will have somewhere to turn for any issue or item of confusion or contention that may arise in their business.

State regulations can vary considerably, so be sure to check with your state’s business authority to confirm what, if any, guidelines and requirements exist regarding LLC operating agreements.

Recommended: Use our Free LLC Checklist to stay focused when starting your business.

The default setting for LLC management is member-managed. This means that all LLC members take an active role in the day-to-day operations of the business. However, LLC members can also elect to be manager-managed by indicating this choice in their articles of organization.

In a manager-managed LLC, members select one or more individuals to serve as on-the-ground management, while retaining authority over major business decisions and operations. LLC managers may be selected from among the company's current members or brought in from outside the company. An LLC may also choose another LLC or corporation to serve in a management role.

While some states may have different requirements, the typical operating agreement should include the following information:

Every LLC operating agreement should include the company’s name and address along with the names and addresses of each member.

Each LLC member's capital contribution should be outlined in the operating agreement — both initial contributions or those that will be made later. This can help determine each member’s ownership percentage and profit share.

An LLC’s statement of purpose should include the nature of the business and what it seeks to achieve. Many statements of purpose are followed by standard language such as, “and for any other lawful business purposes.” Some states allow for a general statement, while others may require more specific details.

Aside from listing each member of the LLC, the operating agreement should outline each member’s role within the business. This includes their duties and voting power. If the LLC is manager-managed, all managers should be named along with their roles and compensation.

LLCs have flexibility in terms of how ownership is distributed, and are not bound by how much capital each member contributes. While many LLCs do go that route, they may also choose to divide ownership based on other metrics such as the level of involvement with business operations. For example, a silent investor may make an equal contribution, but receive a smaller ownership stake than decisionmakers.

Just as ownership percentage is flexible, so too is profit distribution. While profits are typically divided based on ownership, this is not required. An LLC may decide to distribute profits in any way they see fit, as long as all members agree to the system.

The process for how members are added and removed from the LLC should be detailed in the operating agreement. This should also include what happens when a member passes away or if someone must be expelled involuntarily from the company.

Procedures and conditions should be laid out for dissolving the LLC. There should also be a provision covering the transfer of interests if a member chooses to sell her/his stake in the business. Typically, the other members will have a right of first refusal.

Managers may be protected from personal liability as long as they act in good faith. Managers must always act with the fiduciary duties of care and loyalty. If a manager acts with gross negligence or in the interest of personal gain, the manager can be held liable for her/his actions.

Even if a member is appointed as manager of the LLC, voting rights must be established in the operating agreement. Unless the operating agreement specifically states that members will have no voting rights, members can still override a manager’s decisions.

The scope and limitations of managers should be laid out in the operating agreement. Managers lead the LLC’s day-to-day operations and have the power to enter into contracts within the ordinary scope of business. However, major decisions typically remain with the members. To avoid confusion or conflict, specific details on the manager’s role in the business must be outlined.